Invariant FAQs

How is the RWA curve different from other bonding curves like Uniswap’s Constant product or Curve’s StableSwap?

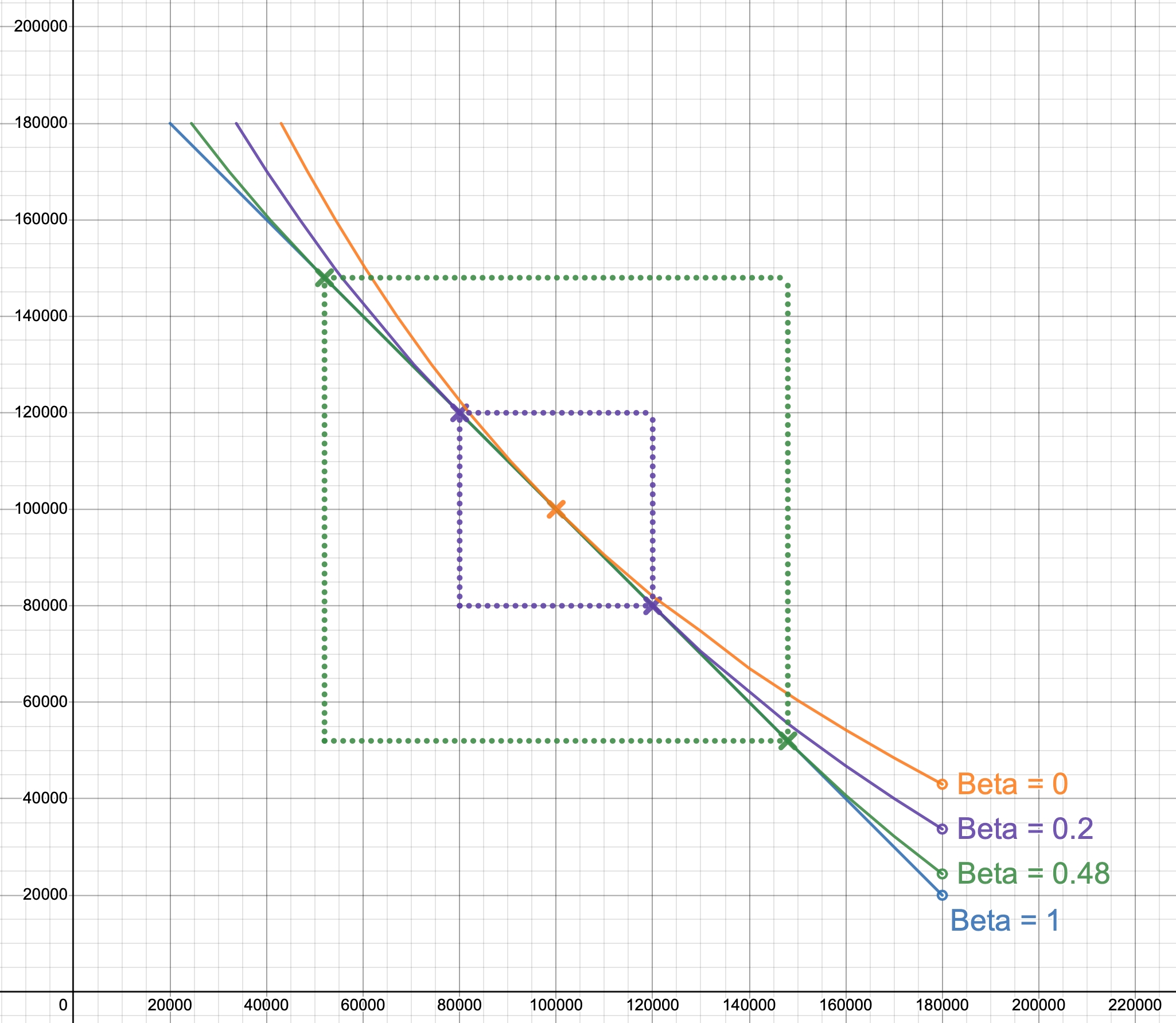

The RWA Pool curve determines price differently between 2 regions. In the beta region the spot price is determined by Chainlink price oracles, and the curve has similar behavior to a constant sum invariant (linear). [Refer to line where Beta=1]. Beyond the beta region the spot price is determined by the ratio of existing reserves (the "LP ratio"). This can be represented by the curvature beyond the beta region.

(https://www.desmos.com/calculator/2qhuh660gd)

This behavior aims to provide a range of "FX accuracy" (the beta region) using less liquidity compared to AMMs that utilize more generalized invariants, such as Uniswap's constant product or Curve's Stableswap.

What are the dimensions of the RWA Pools?

There are 5 dimensions used for the RWA Pools: alpha, beta, delta, lambda and epsilon.

Alpha

Maximum and Minimum Allocation of each reserve

Beta

Depth of Liquidity pool without price slippage

Delta

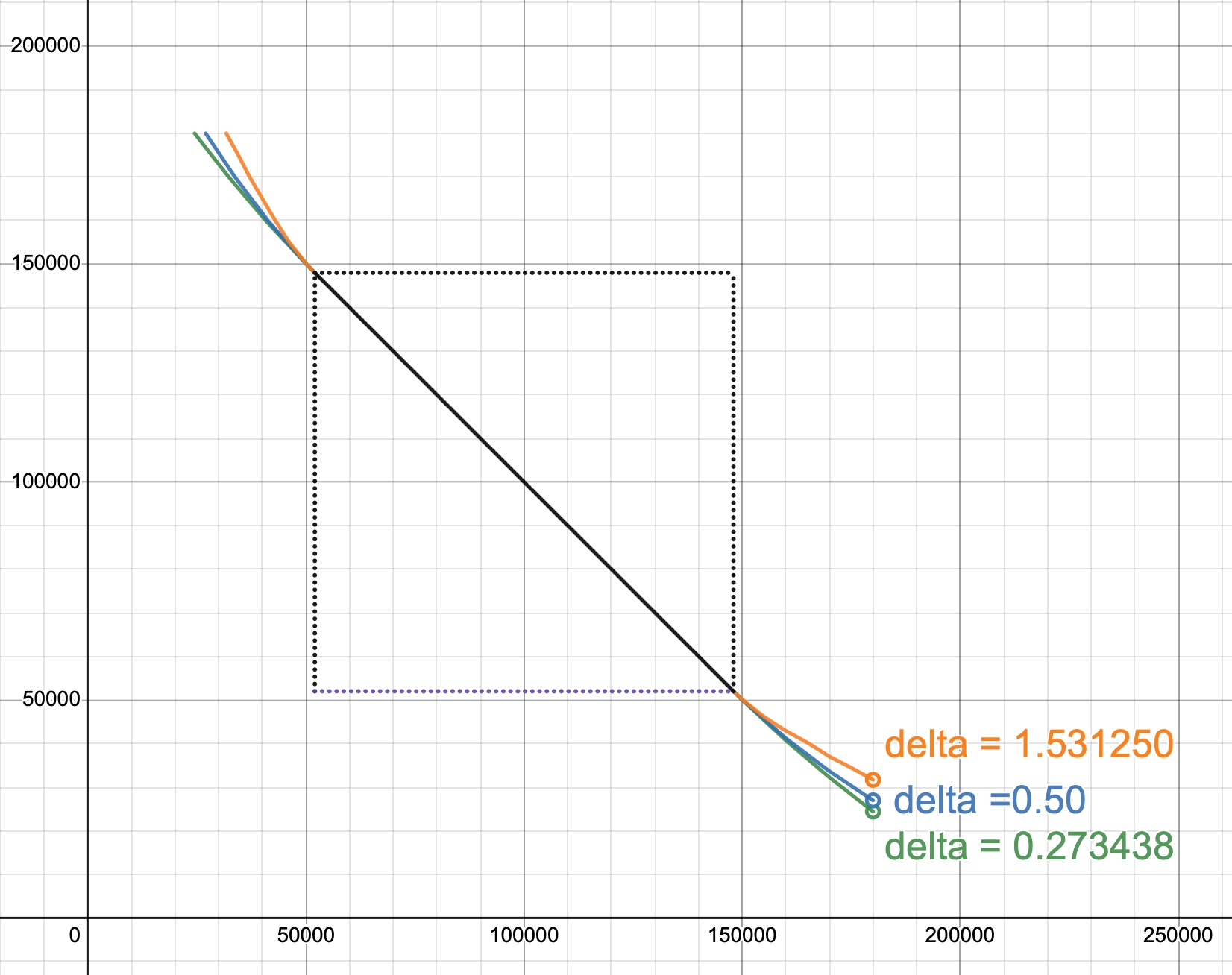

Rate of Price Change

Epsilon

Fixed Fee

Lambda

Dynamic Fee

What determines the rate of price slippage beyond the beta region?

The rate of price slippage beyond the beta region is determined by the value of delta which is determined by the team's internal RWA Liquidity Profile model (https://www.desmos.com/calculator/pfi7o5iirl)

What is the base level of liquidity needed for efficient swapping?

The slippage tolerance is heavily determined by the parameters set for the respective pairs that are deployed (specifically beta and delta as seen from the diagram above). The parameters are set differently for each individual stablecoin pair depending on the stablecoin Liquidity Profile associated to it. Overall, the parameters set will cause a larger change to the slippage as compared to the base level liquidity. As a more tangible example under current production parameters, if a pool has ~35k USD worth of liquidity, it can support ~10k USD worth of FX accurate swaps w minimal slippage. Granted this is use case specific to FX trading, but to do the same with Curve or even Uni V3 would entail multiples more liquidity and/or more active effort (in managing the actively traded range for concentrated liquidity).

At what points of the curve can I arbitrage for maximum profit?

Our RWA Pool uses a dynamic fee solution to encourage FX accurate rates by providing a subsidy to users who trade into the beta region, and charging a higher fees for trades away from the beta region. Trading within the beta region incurs a fixed fee.

Last updated