Pool Operator FAQs

Why doesn't my Burr Pool rebalance to a 50:50 LP ratio?

Burr Pools don't need to stay at the 50:50 ratio in order to offer market accurate rates. In practice, a Burr Pool facilitates market accurate trades anywhere between the 24:76 and 74:26 ratios. This conceptually is a different design compared to constant product or constant sum invariants where the market expects the "true price" to be at the 50:50 ratio or elsewhere, however Burr Pools operate in a range rather than a single point on the price curve.

Will my Burr Pool rebalance automatically or should I rebalance it manually?

Burr Pools are designed to amplify arbitrage incentives beyond the beta region (outside the blue region, segments I:H and J:K). This means that the further traders bring the LP ratio beyond the beta region (currently 24:76 or 76:24 at the time of writing), they will be charged a dynamically increasing fee (or "penalty"). However, if a trader brings the LP ratio back towards the beta region, they will be paid a subsidy for helping to rebalance the pool (taken from the pool liquidity). The penalty will always be higher than the subsidy paid, so the pool will always remain solvent while earning increased fees for LPs.

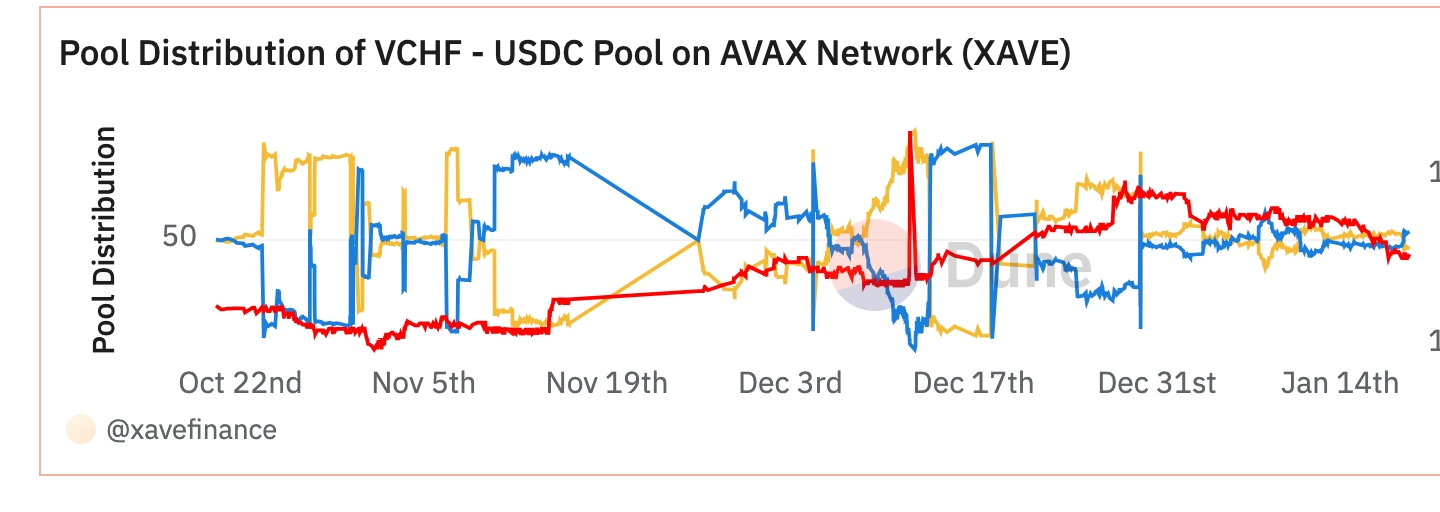

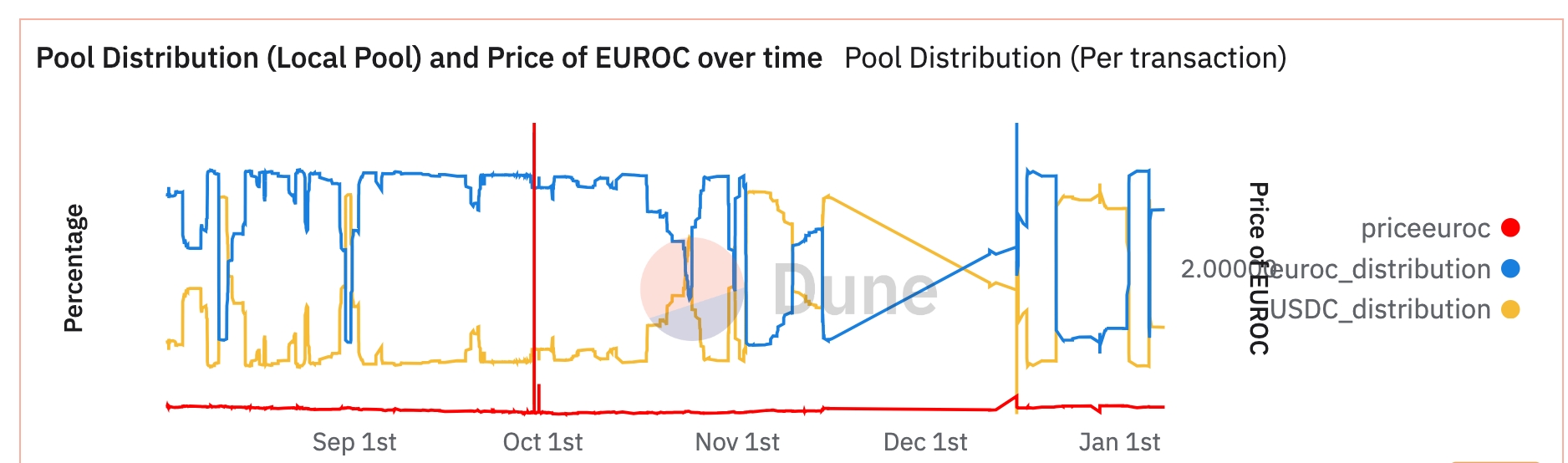

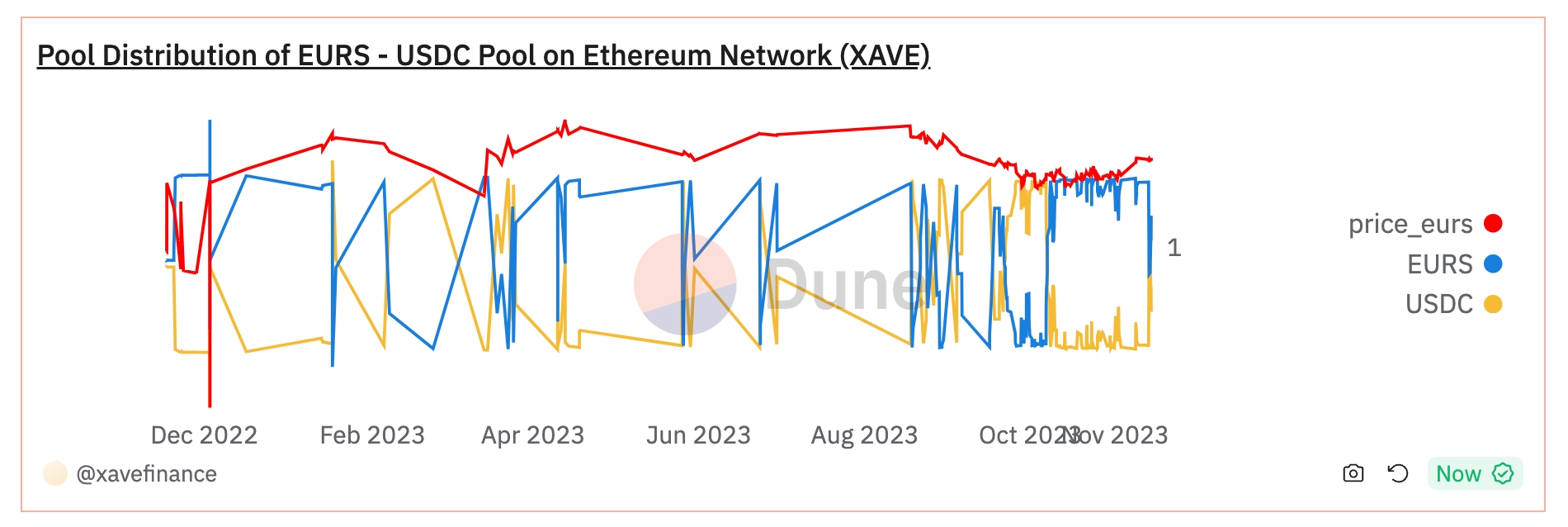

To see this "rebalancing" behavior in action, refer to some historical charts of other pools that have been live by Numeraire, DFX Finance, Xave Finance on Ethereum mainnet and Avalanche.

Should I rebalance my Burr Pool when it goes beyond the 24:76 and 76:24 ratios?

We generally advise pool operators not to manually rebalance Burr Pools, unless absolutely required. Rather than manually rebalancing, we advise seeding liquidity between a Burr Pool and its' external pools to ensure that arbitrageurs are incentivized to carry out this "self rebalancing". As a pool operator, you may also consider running your own arbitrage bot to rebalance a Burr Pool, but make some money while doing it. This also helps to ensure that your Burr Pool remains attractive to traders.

Last updated